A credit card can make a significant difference in your life. While there are many cards available from a variety of financial institutions, it is important to do your research before making a decision. Don't choose the first card you see, and look for these five factors to make your decision easy.

Three easy steps to choose a credit card: Select reviews

The first step when choosing a card is to understand what you need. A rewards program, or discounts at retail might be something you want. You may also be interested in a card with low interest rates. This can help you consolidate your debts and pay them off easily. After you have established your goals, you can compare credit cards to find one that works for you.

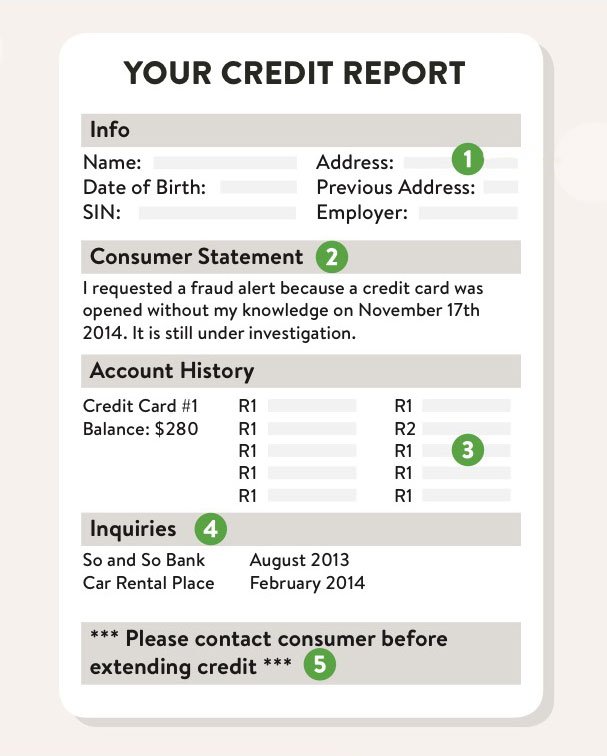

A credit score will help you choose the best credit cards for your needs. Your credit score is what will determine whether you are eligible for a credit card. However, some credit cards have different credit requirements. It is important to know your credit score before you apply for a new card.

Look for a card with a low interest rate

A credit card that charges low interest rates is a smart choice for many reasons. These cards allow you to spend as much as you like and can even improve your credit score. These cards might offer lower interest rates along with travel and reward benefits. Just be sure to read the terms and conditions of the card before signing up for one.

Make sure you consider the annual percent rate (APR) before choosing a card. If you have any balances, this rate will dictate how much you pay interest. If you are looking to pay the full balance off, it is worth choosing a card offering a low APR. Before you apply for a creditcard, compare interest rates and annual charges. Reward credit cards can be a great option for you if your monthly balance is paid in full. These cards give you cash back or free traveling.

Think about reward programs

Reward programs are important to take into account when selecting a credit card. You can use them for many reasons and earn benefits on your everyday purchases. Some rewards credit cards offer special benefits such as access to airport lounges, or tickets to special events. If you are looking to give back and donate your points to charity, these cards can also prove to be beneficial.

Research different reward programs to find the best rewards card. This will help you decide which one best meets your needs. You might also be interested in the other benefits offered each brand. You might be able to pay off your debt faster by using credit cards that offer 0% annual percentage rates for balance transfers. There are credit cards available that offer travel protection.

You should consider fees

There are many fees associated with credit cards. While they can provide a number of benefits and benefits, some can be detrimental to your ability to access them. Annual fees, balance transfer fees, foreign transaction fees, and expedited payment fees can all add up to a significant amount. See the disclosure documents to find out more. These fees are often hidden, so be sure to read them carefully.

There are many fees associated with credit cards. However, most credit cards include an annual fee. These fees range from $95 to 500. Although most of these fees are recurring in nature, credit card companies may waive them for the first year.