Petal is an affordable credit card option that won't break your bank. Petal's app offers 1% cash back on purchases, and there's no annual fee, so you'll save money while gaining the convenience of no-fee and 24/7 customer service. You can apply for a Petal card even if you don't have a credit history. And it doesn't require a credit check, either.

Petal 2 offers 1% cash back

The "Cash Back, No Fees" Visa Credit Card from Petal may sound like a dream, but it isn't. Petal 2 Card will perform a hard pull and soft pull during approval. This credit card is not available to those without a high credit score. You can apply for this card as long your legal U.S. residency is met. This card can be used wherever Visa credit cards are accepted.

Petal 2 can be a great choice for anyone who wants to build credit or receive rewards. There is no annual charge and the card rewards you for paying on time. The Petal 2 does not require a security deposit, unlike many credit-building cards. Persons with bad credit and bankruptcy within the last 48-months are not eligible. The good thing about the Petal 2 cards is that they have no fees. This card can earn you cash rewards as well as statement credits, and there is no credit check.

Petal 1 requires no credit history

You may be interested in Petal 1 if you don't have credit history or any credit. This credit card is for people with average credit and are new to the credit markets or trying to rebuild credit. Petal offers no annual fee and is a great option for students looking for a credit card without the hassle of having to provide a credit history. Although it doesn't provide much flexibility, the credit card comes with a low fee and a variety of other features that may be of interest.

This card offers a high APR with no cashback. However, it does not charge a late fee. The card can be used overseas without any fees. It offers a maximum credit limit of $5,000 There are no foreign transaction fees, and there is no monthly or annual fee. Petal can be a great choice for people who don't have credit histories, but may not be the best. The Petal 1 Visa card might be the right choice for you if you have poor credit or no credit history. Be responsible when using it.

Petal 2 offers no annual fee

Petal 2 card offers cash back rewards and you can get it for every purchase. Earn 1.25% cashback when you pay on time with the Petal 2 card You can also get 10% back from select merchants. There is no annual charge, so there's no need for you to worry about making minimum payments each month. A mobile app is available for Petal 2 cards that allows you to search for merchants with higher reward rates.

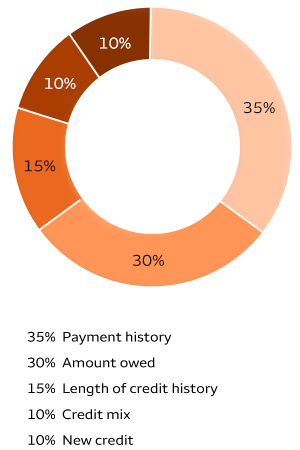

Petal is an excellent card for those with bad credit or poor credit histories. To determine if you have a good credit score, this card uses a proprietary scoring method called Cash Score. Your banking history is also considered, which can be the main reason for low credit scores. High credit utilization and debt can lower your score, so Petal makes sure you don't fall into either of these categories.

Petal offers customer service 24 hours a day

When it comes to payment, one thing that makes Petal stand out is their 24 hour customer service. Contact customer service through the app anytime you have a question about your account. You can also view the list of participating merchants and offers in the app. Petal might have different payment cut-offs depending on where you live. You may also be able to turn off notifications. This can affect your experience. Customers may also call in for help if they're unsure whether they can pay with their accounts.

Petal provides 24 hour customer service and the main product is a credit-card. Their qualification process is based primarily on the users' digital records. It takes into account their monthly incomes and expenses. Petal has different products for different customers, and these metrics are critical in determining whether a person is eligible for a credit-card. You will also find lower rates for the introductory products, which is appealing to responsible individuals.