Pre-approval credit card offers are often offered by credit card issuers to new cardholders. This type offer allows new cardholders to feel more confident applying for a new account. These cards offer intro offers up to $300 cashback. These offers are especially appealing if you have bad credit.

Pre-qualification

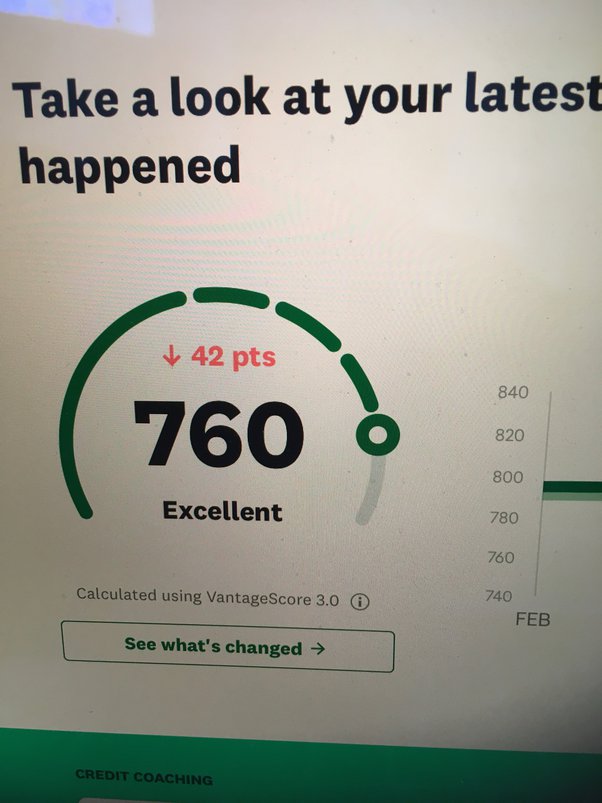

A pre-qualification for bad credit cards helps you know your approval odds before you apply. Pre-qualification tools are soft inquiries that help you avoid being denied for a credit card. This can also help to select the right products, terms and rates. Most cases it will take time for your credit to be repaired. It is best to wait before applying to a new card.

Although pre-qualification is limited to a small portion of your finances it can greatly increase your chances for approval. Pre-qualification can be obtained through major credit card companies including American Express, Discover, Capital One, and Discover.

Pre-approval

Pre-approval credit accounts for bad credit reduces your chance of being declined. These cards are usually based on pre-screened consumer list that the card issuer has obtained from credit bureaus. These pre-screenings can give you better product selections and more favorable rates. Before you apply for pre-approval, make sure to verify your credit reports for any errors or derogatory markings.

A pre-approval credit card uses a soft credit check that does not look at your debt-to-income ratio or full payment history. This will not affect your credit score. Your credit score will be temporarily affected by a hardcredit check. You should fully understand the terms of each pre-approval credit cards offer to minimize this risk.

Secured

Bad credit people can get a secured credit card. This card does not require a security deposit. It is only available for a very limited period of time. Many of them report payment activity directly to one of three credit bureaus, Experian or Equifax. Before you sign up for any card, be sure to read the terms.

The primary difference between a secured and an unsecured credit card is the security deposit. The security deposit is typically between $200 and $5,000 and serves as your credit limit when you open an account. The advantage of a secured card is that you have access to credit and can start building your credit history.

Unsecured

Bad credit might limit your access for unsecured credit card, but it does not mean you can't apply. One of the most important things is to find one that caters to people with low credit scores. While these cards may have high annual fees and credit limits, they can be used responsibly to build your credit score. To avoid expensive interest charges, make sure you pay all your bills on time and maintain a low balance.

A unsecured creditcard is an option for people who have bad credit. This can make a significant difference in your financial situation. These credit cards offer a safety net for emergency purchases, and they also let you pay off balances over time. You can even transfer your balances to unsecured credit cards, which can help you rebuild your credit.

Low-maintenance

A low-maintenance preapproved credit card can be a great choice for those with low credit ratings. These cards have a low annual charge, no monthly fee, as well as no international transaction charges. Late fees are not charged. Cardholders will also be eligible for an increase in credit limits after six months provided that they keep within their credit score range. In addition, cardholders will be eligible for cashback of up to 10% at selected merchants.

Low-maintenance pre approval credit cards are available from many issuers. You will need to check your credit history and understand the APR before applying. Many issuers will run a soft credit investigation on applicants before they approve them. Although this inquiry won't have any negative impact on your credit score, it may temporarily lower your credit score. Before signing up for any credit card offer, be sure to review the terms and conditions.