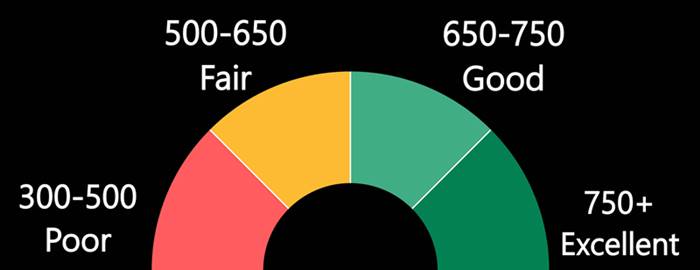

You are looking for the best student cards offers? This article will discuss the Bank of America's Discover It(r) Student Cash back, Capital One's journey Student Rewards and Sallie Mae’s Accelerate. Discover's 100% cashback match can also be found. A student credit card can be a smart investment, regardless of your financial situation. You will be able save money while paying off the balance. Then you can travel with the money.

Bank of America's Discoverit(r), Student Cash Back

The Discover it(r), Student Cash Back credit card offers a competitive rate for cash back rewards. The card comes with an introductory cash back match up to 15% on purchases. There are many bonus categories. Bonus categories rotate quarterly, and you must sign up for them in order to earn rewards. You cannot earn rewards retroactively. The introductory cash back match is good for a first-time cardholder.

Discover it Student Cashback card is a rotating-category credit card that rewards higher cashback when you purchase in bonus categories. These categories change each quarter. Students who meet these requirements receive a $20 statement credits. These categories are subjected to a $1.500 quarterly cap. It is best to limit your spending. A $200 bonus yearly would be great if you plan to keep your card longer than one year.

Sallie Mae Accelerate

Sallie Mae student credit cards will help students pay off student loan debts. This card provides unlimited cashback up to 1.25% on all purchases. There is no cap on the amount you can earn in cash back. It also offers a 25% bonus on cash back rewards for the first six months of use. The card's best feature is its student-friendly design that allows you to make timely payments.

Sallie Mae Accelerate student cards offer a range of useful tools to help you manage your account. You can access your account from your phone, making it easy to pay your bills, check your statements, set up alerts, and more. From the app, you can also pause or suspend your card. This credit cards also offers many other perks, making it the ideal credit card for students.

Capital One's journey student rewards

Capital One's journey Student Rewards Credit card: This card is perfect for anyone who is going abroad for the summer. No foreign transaction fees! No more worrying about foreign transaction fees of 3%! This is great news for students participating in exchange programs or traveling abroad. You can travel to the United Kingdom, spend money and not worry about fees.

Negatives: The Capital One Student Rewards Annual Percentage Rate is high. It's also not the best card to balance transfer. The rewards for this credit card are not worth the high annual rate if you use it only to make purchases. It's worth the reward program and security that it offers, though, if it's your plan to use it as a travel credit card. But be careful: there are other cards with lower annual percentage rates. Before making a decision, you should carefully consider all options.

Discover our 100% cashback match

Discover's 100% cashback match is unlimited for student purchases the first year. You can use the bonus to redeem $20 in statement credits for each subsequent five years. An additional $20 statement credit is available each year for students who maintain high grades. In addition, you will earn 5% cashback on purchases in certain categories and 1% back on all other purchases. This is an excellent deal that will allow you to quickly start receiving cash back.

The Cashback Match is one of the most attractive features of the card. It will match any cash you earn in the first year. You will only have to make your first purchase within the cashback match period. After that period, cashback rewards are not available for purchases made outside of the match period. This is fantastic news for students living on a strict budget. Don't let this fool you into signing up to a card. It is worth trying before you commit to a large purchase. In the first year of your life, furniture, appliances and lighting may be necessary.