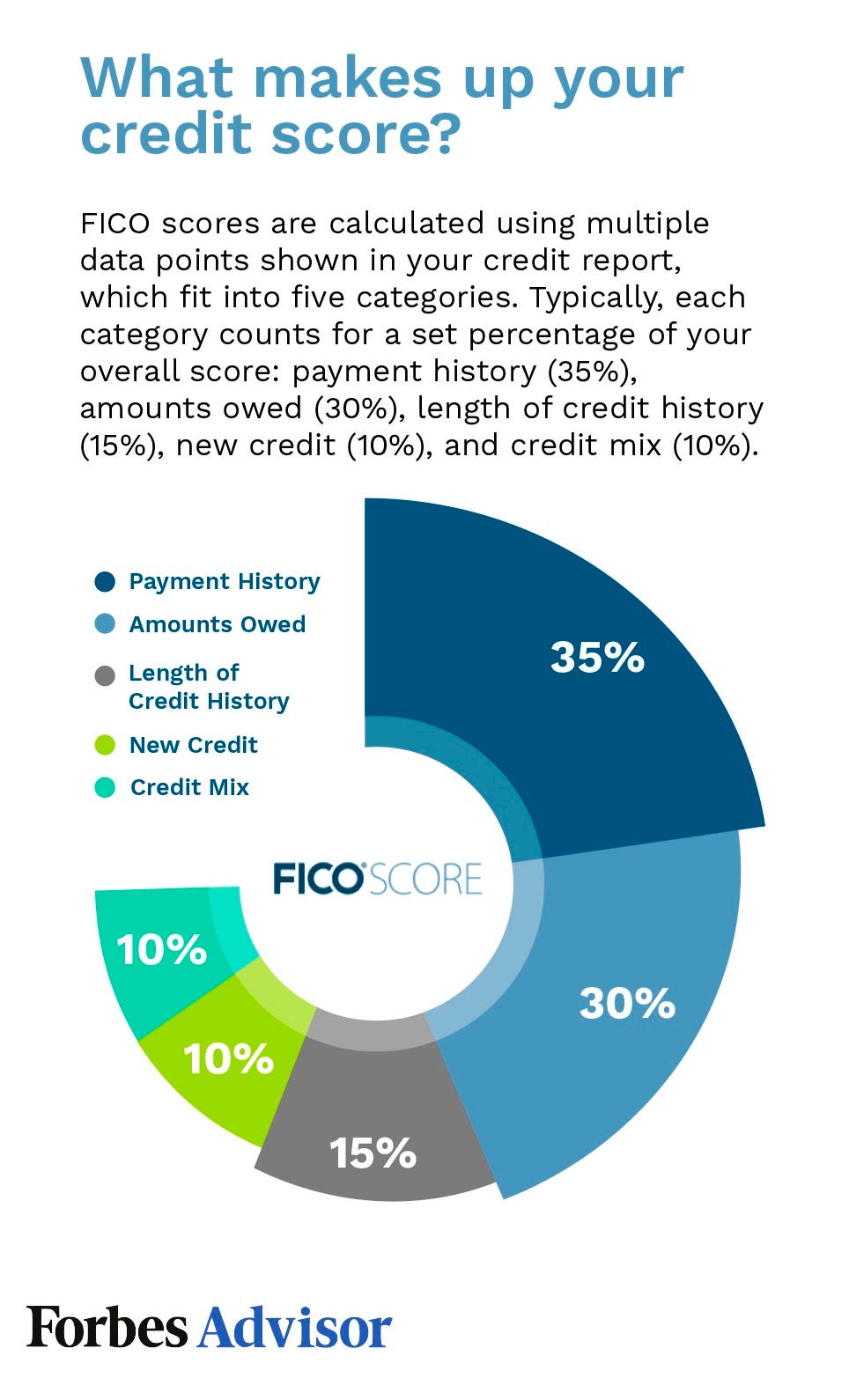

Perhaps you've heard about the three main types credit scores: TransUnion Equifax, Experian, and TransUnion. Each company has its own model, so it is important to understand how these companies calculate your credit score. The three main models are based on your credit history and are designed to be more inclusive to new and infrequent users. You may have trouble getting credit approvals if you have a very low credit score.

TransUnion

TransUnion and other credit scores can be used to provide lenders with a snapshot of a consumer’s creditworthiness. The scores are free and are used by lenders to make lending decisions. These scores can be different from one lender or another. Lenders may use the same scoring system but they might view an applicant differently depending upon how their scores were calculated.

TransUnion scores vary from 300 to 850 with the lowest at 300. Equifax scores on the other hand range from 228 to 850. Both bureaus consider the average age and history of payments more important. FICO scores are more extensive and are based on credit history and financial condition.

Equifax (TransUnion), Experian, and TransUnion are America's three main credit bureaus. Each one uses different scoring models, so the scores may differ. It is crucial to check your credit reports at all three agencies.

Experian

They are not static, however. They change depending on how you spend your money. Credit scores can be calculated using statistical algorithms. Each bureau has its own calculation method and every score is unique. To get your exact score you will need to consult your credit history with the bureau.

There are many ways you can raise your score. Some credit score builders can help you raise your credit score for free. For example, you can sign up for Experian Boost, which is a tool that can raise your credit score by 13 points. But not everyone is eligible for this service. It is available only to eligible customers who pay their bills via an eligible account.

You should always check your credit score from all three credit bureaus. Each bureau has a different score by 50 points. TransUnion and Experian often use different formulas to calculate your score.

Equifax

The Equifax is a type of credit score that lenders use to determine your eligibility for a loan. The score is based on the number of credit cards you have, how you pay off those cards, and the length of your credit history. You should be aware that your score may change over time. You should compare your score to the same time period of the past to determine if you are eligible.

Equifax, a major credit bureau, has a large consumer credit score database. But there is a problem. The company recently made a mistake in the coding of some credit scores, resulting in a miscalculation of some information. Although millions of people did not notice any material changes, this mistake affected many consumers.